Banks Were Fined Millions for Not Keeping Records of Messaging Apps. The Solution is Easy.

Remember when the only ways to get in touch with a brand were to call their toll-free number or visit a store? Those days are long gone. Today, more and more consumers turn to apps like WhatsApp, Facebook Messenger, Instagram Messenger, and others to ask questions and get information.

In fact, Meta research tells us over half (56%) of Messaging app users across the globe have messaged brands to get more information throughout the purchase journey.

56% of Messaging app users across the globe have messaged brands to get more information throughout the purchase journey.

Meta

Brands across all industries must be equipped to engage with customers via their beloved messaging channels. Banking and financial services brands are no exception.

But these financial institutions must go about it in the right way.

Recently, several banks faced hefty fines for their failure to properly maintain conversations via messaging apps. And just a few days ago, the Securities and Exchange Commission (SEC) announced a group of 10 brokerage firms and money managers will pay nearly $100 million in fines for similar violations.

Read on to learn what went wrong – and how 1440’s Messaging Studio could have helped these banks engage with customers via their preferred channels, without incurring financial and reputational penalties.

What Financial Institutions Got Wrong

Consumers want to be able to interact with banks and other financial institutions via messaging. Some financial institutions have taken note – and started engaging with their customers through these channels.

But recently, multiple US financial firms – including Wells Fargo – found themselves in hot water with both the SEC and the Commodity Futures Trading Commission (CFTC) over interactions on messaging apps. Specifically, their offense was failing to keep records of these conversations.

Collectively, these financial institutions will have to pay $549 million in fines for failing to properly maintain these conversations. That’s not to mention the damage to their reputations.

Even more recently, the SEC announced 10 brokerage firms and money managers – including Baird, William Blair, Nuveen, and Fifth Third – will pay nearly $99 million in fines for non-compliant usage of messaging apps such as WhatsApp and iMessage.

There’s an Easy Solution for Keeping Records of Messaging Conversations

The banks in question clearly understood consumers’ growing preference for messaging apps. But the way they went about engaging via messaging apps ended up costing them.

However, there is a simple solution to engaging with customers via messaging apps – in a way that maintains compliance: Messaging Studio by 1440.

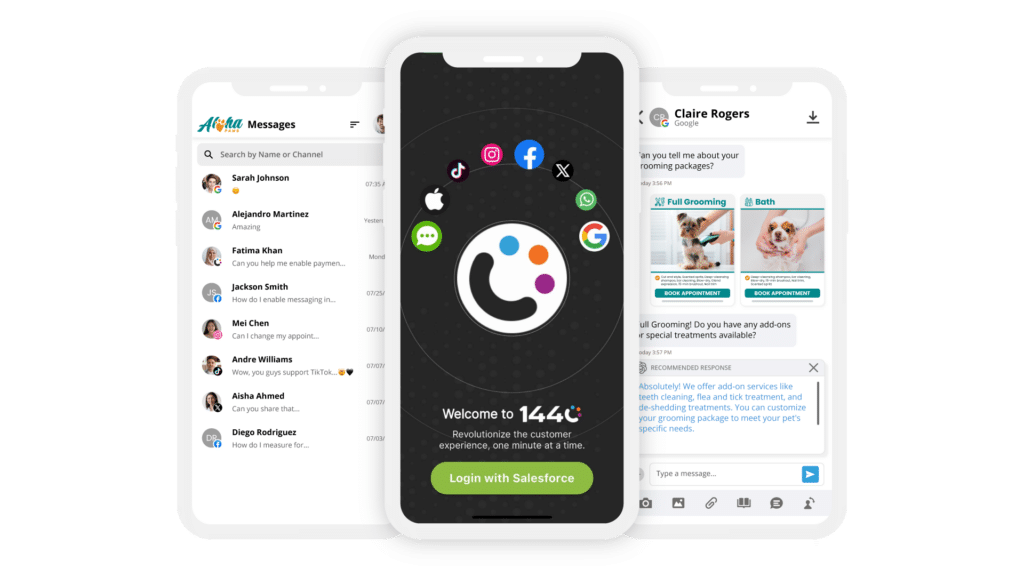

Meet Messaging Studio

Customers want to interact with your brand through messaging channels. But not all of your employees are sitting behind a desk. We get it.

But allowing your mobile employees to use these messaging apps natively on their own phones isn’t the right approach either. Look where that got Wells Fargo and other financial institutions.

Now, there’s a better way.

Messaging Studio is the fastest, most convenient way for mobile employees to engage with customers via digital channels – including the most popular messaging apps. Of course, that includes the standard Salesforce Digital Engagement channels like SMS, WhatsApp, and Chat. However, 1440 has additional integrations with:

- Google Business Messages

- Meta (Facebook, Instagram)

- TikTok

- X (Formerly Twitter)

- Line

- Kakaotalk

That means you’ll never miss an opportunity to connect with customers, wherever they are.

Messaging Studio from 1440 is embedded directly in the Salesforce app – which means mobile employees can engage with customers on their favorite digital channels – right where your customer data and business processes live.

Messaging Studio equips employees with a ton of great Sales productivity tools that make it easy for them to provide consistent, engaging, and accurate information to every customer every time. For example, an employee in a brick-and-mortar store location can share images and videos captured via their phones with a customer via messaging. All of this content is securely stored in Salesforce so managers can always see what customers are seeing.

The app also taps into AI by providing reply recommendations. These one-tap responses can be especially helpful for employees working in noisy, distracting environments.

Messaging Studio also saves conversational history across channels. That means a mobile employee can see a complete history of all the interactions that have been exchanged with this customer in the past – even if it was with a different employee or even a chatbot. This provides context to the employee that can help them pick up right where the customer left off last time.

Finally, your conversations across channels are saved in Salesforce, rather than on your employees’ phones. That’s where the banks went wrong!

Start Tapping into Messaging Channels to Engage with Your Customers – Wherever They Are

Increasingly, consumers prefer to engage with brands via messaging channels. Brands must be equipped to communicate with their customers throughout the purchase journey – wherever they are.

Your store, field, and mobile employees are a big asset. They’re knowledgeable about your products and services, so they’re well-equipped to provide information and answer customers’ questions digitally. But handing them a phone with different messaging apps installed on it isn’t the right approach.

Instead, empower your employees with Messaging Studio, available on the Salesforce AppExchange. Your employees can easily deliver winning messaging experiences customers love. And because it integrates with Salesforce, you never have to worry about those conversations going missing.

Ready to see the 1440 mobile app in action? See a demo today.